Price level def.

the average price of goods. (typically in a market basket.)

Market Basket def.

A selected group of consumer g/s whose prices are tracked for the purpose of calculating a consumer price index. (measures cost of living.)

Consumer price index(CPI) def.

a measure of the average change over time in the prices paid by consumers for a market basket of g/s.

Inflation Rate def.

The % increase in the average price level of g/s over a period of time.

Inflation def.

General, sustainable upward movement of average prices for goods & services. Can also mean a sustained fall in the purchasing power of money.

Deflation def.

Occurs when price levels go down over time.

Creeping Inflation def.

A certain, and expected, amount of gradual inflation every year, typically from 2-3%.

Hyperinflation def.

Occurs when inflation is very high and rapidly increasing.

What are the 3 theories on the causes of Inflation?

Quantity theory, Demand-Pull theory, and Cost-Push theory.

What is Quantity Theory?

Too much money in circulation in the economy. Meaning Money supplied must be carefully monitored.

What is Demand-Pull theory?

Increase in overall demand.

Causes:

-Rapid Economic Expansion: consumers spend more= steady increase in demand=higher prices.

-Increased Govt. Spending: Govt. spends more freely

-Future Expectations: increase prices expected in future inflation.

What is Cost-Push theory?

Factors of production cost more.

Causes:

- External shocks: conflict, war, natural disaster

Effects of Inflation, and what do they mean?

Purchasing power/income: reduces amount of g/s money can buy.

Interest Rates: as price increases interest rates increase. Interest rates are raised to ensure they receive profit.

Savings: saved money will lose its value it once had before.

Why is deflation undesirable? why isn't an inflating rate of 0% desired?

People will not loan money, and it leads to decline in real GDP.

What is the Business Cycle?

Describes fluctuations in economic GROWTH & DECLINE.

What happens during an Expansion? (Describe: GDP, Unemployment, Consumer Behavior, Business Behavior, and Housing Market, Inflation & Interest Rates.)

Real GDP is increasing. Unemployment is low. Consumer Behavior increases. Business Behavior increases, expansion of the company. Both are confident in spending. The Housing Market is increasing, new homes being built. Inflation & Interest Rates are increasing.

What is a Peak?

Maximum economic output. Marks the turning point into a period of decline.

What happens during a Contraction? (Describe: GDP, Unemployment, Consumer Behavior, Business Behavior, and Housing Market, Inflation & Interest Rates.)

Real GDP is decreasing. Unemployment increases. Consumer Behavior decreases. Business Behavior decreases, close stores. Both lose confidence in spending. The Housing Market is decreasing, foreclosures may occur. Inflation & Interest Rates both decrease.

Describe Types of Contractions:

Recession: Prolonged contraction lasting 6-18 months

Depression: Long, severe recession(18 months or longer.) High unemployment& low factory output.

Stagflation: Decline in real GDP (output) & rise in price level (inflation). Economy is un-moving.

What is a Trough?

Minimum economic output. Marks turning point to a period of recovery or growth.

What is the Growth Trend Line?

Shows a clearer picture of the overall growth/trend of economic activity over time.

What are the 3 indicators in the business cycle? Describe them.

Leading (Before a change in phases): Housing Market (Contraction = “Buyer’s Market”; Expansion = “Sellers Market”

Coincident (Simultaneous with changes in phases): Unemployment

Lagging (After a change in phases): Inflation & Interest Rates

Factors that may influence the Business Cycle

Business Decisions

Interest Rates

Consumer Expectations

External Shocks

Business Investment:

hire more and spend more. This contributes to economic expansion (Rise in real GDP).

Spend less=impact on unemployment=GDP increases.

Consumer expectations:

influence consumer spending. If downturn expect an economic down-turn they may save more and spend less causing a decrease in GDP. When they are confident about the economy they often spend more, increasing GDP.

Interest Rates & Credit:

Increased interest rates make it harder for consumers/businesses to borrow money. This may contribute to economic decline.

External Shocks:

Negative: disruption in oil supply, droughts, stock market crash, terrorist attack

Positive: Sudden innovation in science or technology, discovery of mineral deposit, surplus crop

Define federal spending:

The budget reflects decisions to tax and spend, to borrow and lend, and to consume and invest.

Define fiscal year:

a 12-month accounting period that a business uses for financial and tax reporting purposes.

Mandatory spending

govt. required to spend on certain programs.

Discretionary spending

govt spending that there is a choice in

Examples of Mandatory Spending:

Entitlements: people that meet a certain criteria for entitlements.

"Mean-tested": Benefits are dependent on income

Social Security: Monthly benefits retired or survivors or disabled people & their families receive.

Medicare: programs paying for hospital care and medical services. usually for over 65.

Medicaid: Benefits low income families, disabled, elderly by assisting with medical care costs.

Examples of Discretionary Spending:

National Defense, Transportation, Education, Energy, etc.

Deficit def.

Spending more than you make

Debt def.

The total of every time we overspent. All annual deficits since 1776.

What was caused the National Debt?

spending on wars, increased govt. spending during recession, and taxes decreased.

Where does the govt. get money when it wants to spend more than it takes in?

Bonds. You're loaning money to the govt. to be later compensated with interest.

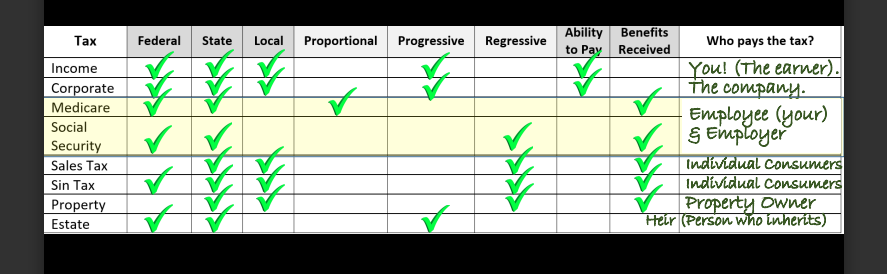

Taxes def.

required payment to local, state or national govt.

Revenue def.

Income received by govt.

Tax Base def.

something that is taxed. Four main types: Income, corporate, property, and sales.

What are the purposes of taxes?

1. Generate revenues to support functions of government

2. Pay

for infrastructure and other public services

3. Promote social

& economic goals

4. Used to redistribute income

Criteria for taxation?

EQUITY(fair): Established by how uniformly a tax is applied and the fairness of the burden it imposes.

ABILITY TO PAY: Individuals & entities should be taxed based on their ability to pay.

BENEFITS RECEIVED:Individuals who benefit directly from public

goods/services

should pay for them in proportion to the amount of

benefits received.

SIMPLICITY: Determined by how easy it is for the taxpayer to understand and how easy it is for the government to collect.

EFFICIENCY: Judged by how well the tax achieves the goal of raising

revenue for the

government with the least cost in terms of administration.

What is a Proportional tax structure?(Definition, Pros&Cons)

A tax for which the % of income paid in taxes remains the same for ALL income levels. Pros: Simplicity. Fair because everyone pays the same rate regardless of income.(Equitable) Cons: The tax burden is disproportionate & a larger burden on lower incomes.(Ability-to-pay)

What is a Progressive tax structure? (Definition, Pros&Cons)

A tax for which the % of income paid in taxes increases as income increases. Pros: Fair because it requires those with a greater ability to pay taxes to pay more than those who do not. Cons: can discourage investment, entrepreneurship, and economic growth, as individuals may have less incentive to earn more if a significant portion is taxed at higher rates. May encourage tax evasion to minimize tax liabilities. Not simply--complex.

What is a Regressive tax structure? (Definition, Pros&Cons)

Percentage of income paid in taxes decreases as income increases. Pros: straightforward & easy to administer, typically involve a fixed tax rate. Some argue regressive taxes on certain goods can discourage undesirable consumption. "user pays" principle. Everyone pays the same tax rate on the taxed goods or services. Cons: Impose a greater financial burden on lower-income individuals.

W4

a document used by employees to inform their employers about how much money to withhold from their paychecks in order to pay federal income tax.

Withholding

money taken from (or withheld) from pay before the worker received it.

Payroll Taxes

taxes that are withheld from an employee's paycheck by their employer and are used to fund various government programs and benefits (primarily Social Security & Medicare).

W2

a document used by employers to report an employee's annual earnings and the amount of taxes already withheld from their pay.(Needed for filing taxes)

Tax Return

form used to report income and taxes owed to the government.

Gross Income

the total amount of money an individual/entity earns before any deductions, taxes, or expenses are subtracted.

Deduction

an expense that can be subtracted from a taxpayer's gross income to determine their taxable income.

Taxable Income

the portion of income subject to taxation.

Tax Rebate

a refund of overpaid taxes that is issued by the government to a taxpayer.

APRIL 15TH!

Date taxes are due each year

Tax Incidence:

Tax incidence refers to the redistribution of the burden of a tax onto other individuals/groups. Ultimately, it reflects who bears the ACTUAL cost of a tax.

Corporate/Business Taxes

Corporations often pass the burden of increased taxes on to consumers employees, and/or shareholders.

Sales/Sin Taxes

Consumers bear the burden of taxes on in-elastically demanded goods Suppliers bear the burden of taxes on elastically demanded goods.

Property Taxes

Property owners who rent out space to tenants, businesses, and so on may pass the burden of various property taxes onto renters.

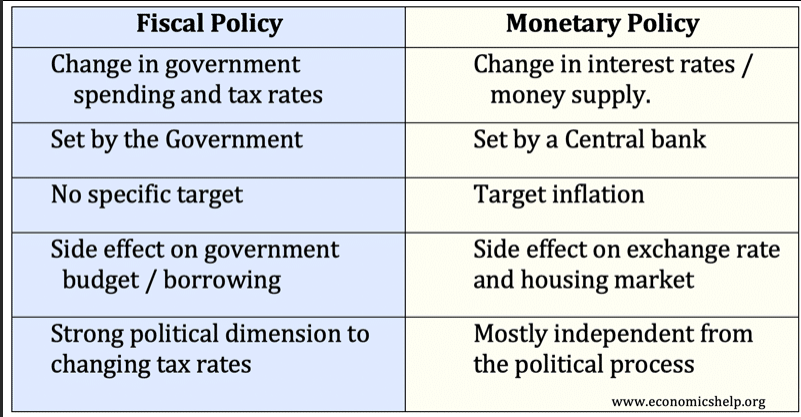

Goal of monetary policy

to increase the money supply just fast enough to keep up with economic growth – but no faster.

Reserve ration

A minimum percentage of deposits banks must keep in reserve at all times.(Banks cannot loan out all the money they take in).

Interest Rate

Banks can borrow money from the Federal Reserve Bank to shore up their reserves. The interest rate on these loans is known as discount rate.

OPEN-MARKET OPERATIONS

Involves the buying and selling of government bonds. (The Fed’s most used tool)

Expansionary fiscal policy

used in a recession (or when predicting a recession) to speed the economy up.

What is the goal of Expansionary fiscal policy? When is it used?

Expand economy, increase output, reduces unemployment .

Contractionary fiscal policy

used to slow the economy down and avoid inflation. (If producers cannot expand production enough to meet demand → will raise prices → which leads to inflation)

What is the goal of Expansionary fiscal policy? When is it used?

Slows economy to avoid inflation, decrease output, decrease demand.

Ways to achieve goal? Explain chain reaction. (Expansionary Fiscal Policy)

Increase spending; Increases demand-output increases-employment increases. Cut Taxes; individuals keep money-consumers/businesses spend more- businesses raise prices&production increases.

What is the goal of Contractionary Fiscal Policy

slow economy to avoid inflation-decreases output- decreases demand.

Ways to achieve goal? Explain chain reaction. (Contractionary Fiscal Policy)

Decrease Spending; Decreases demand-production decreases- unemployment increases. Increase taxes; individuals/businesses have less money to spend-demand decreases-production decreases.

Laffer curve

Taxes increase = Tax revenue increases.

The Multiplier Effect

explains how money is spend as it moves through the economy.

Limits of Fiscal Policy

Difficulty Changing Spending Levels & Concerns; Mandatory vs. Descretionary. Changing spending is likely to cause deficit spending resulting in increased national debt.

Predicting The Future; Difficult to predict speed of changes in business cycle OR future behaviors of individuals.

Delayed Results; Changes take time! Tracking trends, determining courses of action, implementing and then reanalyzing takes time. Political Pressures; President/Members of congress often do what benefits the people who elect them versus what is good for the economy.

Coordinating Fiscal Policy branches & levels of

branches & levels of

government must work together, which is

difficult. Smaller economies differ widely. Short & long-term

effects of changes my vary.

Easy Money Policy

The Federal Reserve follows an easy money policy, encourages economic growth & lowers the unemployment rate.

Tight Money Policy

The Fed adopts a tight money policy to slow economic growth& decrease inflation rate.

Goals of Easy Money Policy:

RESERVE RATIO

DECREASE! Banks decrease reserves,

which

increases lending, which increases money in the money supply, which

increases spending) INTEREST RATES

DECREASE! (People are more willing to borrow money,

money supply then expands) OPEN MARKET

OPERATIONS Buy Bonds. (Federal Reserve buys bonds,

which increases reserves, which increases lending, which increases the

money in the money supply)

Goals of Tight Money Policy:

RESERVE RATIO

INCREASE (Banks increases reserves, which decreases

lending, which decreases money in the money supply,

which

decreases spending) INTEREST RATES

INCREASE! (People are less willing to borrow money,

money supply then decreases) OPEN MARKET

OPERATIONS Sell Bonds. (Federal Reserve sells bonds,

which takes money out of the money supply)

...