Instructions for Side by Side Printing

- Print the notecards

- Fold each page in half along the solid vertical line

- Cut out the notecards by cutting along each horizontal dotted line

- Optional: Glue, tape or staple the ends of each notecard together

igcse economics

front 1 Definition of PPC (Production Possibilities Curve) | back 1 A graphical representation that illustrates the maximum combination of two goods that can be produced by an economy with all the available resources. |

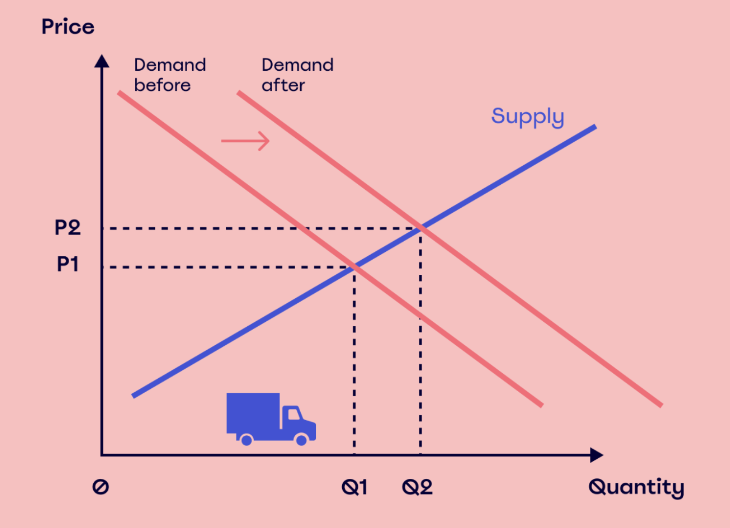

front 2 Definition of demand curve | back 2  A demand curve is a graphical representation of the price and quantity demanded (QD) by consumers. Image shows increase |

front 3 Definition of demand | back 3 Demand is the want and willingness of consumers to buy a good or services at a given price. |

front 4 Resources | back 4 Resources are the inputs required for the production of goods and services. |

front 5 The fundamental economic problem is... | back 5 The fundamental economic problem is that there is a scarcity of resources to satisfy all human wants and needs. There are finite resources and unlimited wants. |

front 6 Scarcity | back 6 A lack of recourses. the basic economic problem where finite resources are available in relation to infinite human wants and needs. |

front 7 Finite resources | back 7 Finite resources are those that exist in limited quantities and cannot be replaced at the rate they are being used. |

front 8 Economic goods | back 8 Economic goods are those which are scarce in supply and so can only be produced with an economic cost and/or consumed with a price. |

front 9 Free goods | back 9 Free goods are those which are abundant in supply, usually referring to natural sources such as air or sunlight. |

front 10 the factors of production | back 10 The factors of production are the resources used to produce goods and services. |

front 11 Land is defined | back 11 Land is defined as all natural resources used in the production of goods and services. |

front 12 Labour refers to | back 12 Labour refers to the human effort, both physical and mental, that is used in the production of goods and services. |

front 13 Capital is defined as | back 13 Any human-made resource used to produce goods and services. |

front 14 Enterprise | back 14 The ability to take risks and bring together the various factors of production to produce goods or services. |

front 15 Opportunity cost | back 15 The next best alternative that is sacrificed when a decision is made. |

front 16 Points on PPC | back 16 If below the economy is inefficient, because it is producing less than what it can. Outside the PPC, is unattainable because it is beyond the scope of the economy’s existing resources. If shifts to left means economy shrinks, if to right means economy grows. |

front 17 Economy | back 17 An area where people and firms produce, trade, and consume goods and services. |

front 18 Microeconomics and decision makers | back 18 Microeconomics is the study of individual markets and sections of the economy, rather than the economy as a whole. Microeconomic decision makers are producers and consumers. |

front 19 Macroeconomics and decision makers | back 19 Macroeconomics is the study of an entire economy, as a whole. Macroeconomic decisions are made by the government of the particular economy |

front 20 Resource allocation and basic economics questions | back 20 The way in which economies decide what goods and services to provide, how to produce them and who to produce them for. In bold are called ‘the basic economic questions’. |

front 21 Market | back 21 Market is an arrangement that brings together all the producers and consumers of a good or service, so they may engage in exchange. |

front 22 Market equilibrium | back 22 Market equilibrium refers to the point where the quantity of a good or service demanded by consumers equals the quantity supplied by producers, resulting in a stable market price. |

front 23 Market disequilibrium | back 23 A situation where the quantity of a good or service demanded by consumers does not equal the quantity supplied by producers. Results in too much demand or excess supply |

front 24 How a market system works | back 24 A market system works to allocate scarce resources through the forces of demand and supply (the price mechanism) |

front 25 price mechanism | back 25 The process where prices of goods and services are determined by supply and demand in a free market. |

front 26 Definition of effective demand | back 26 Effective demand is where the willingness to buy is backed by the ability to pay. |

front 27 Quantity demanded. | back 27 The effective demand for a particular good or service. |

front 28 Individual demand | back 28 Individual demand is the demand from one consumer. |

front 29 market demand | back 29 The total (aggregate) demand for the product. |

front 30 aggregate demand | back 30 The total demand for all goods and services in an economy at a given overall price level. |

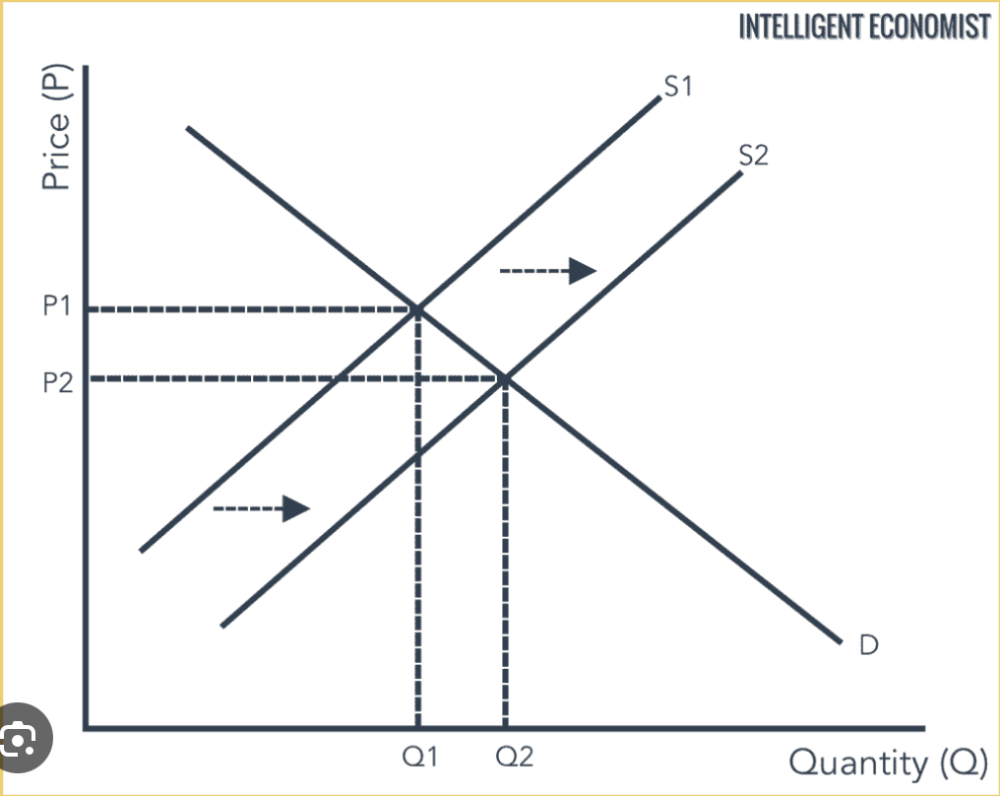

front 31 Supply curve drawing and definition of supply | back 31  The amount of a good/service that a producer is willing and able to supply at a given price in a given time period. Image shows increase. A shift to the left or right is caused by any factor other than change in price. A change in price causes a contraction or extension up or down the line. |

front 32 Causes of supply curve shift | back 32

|

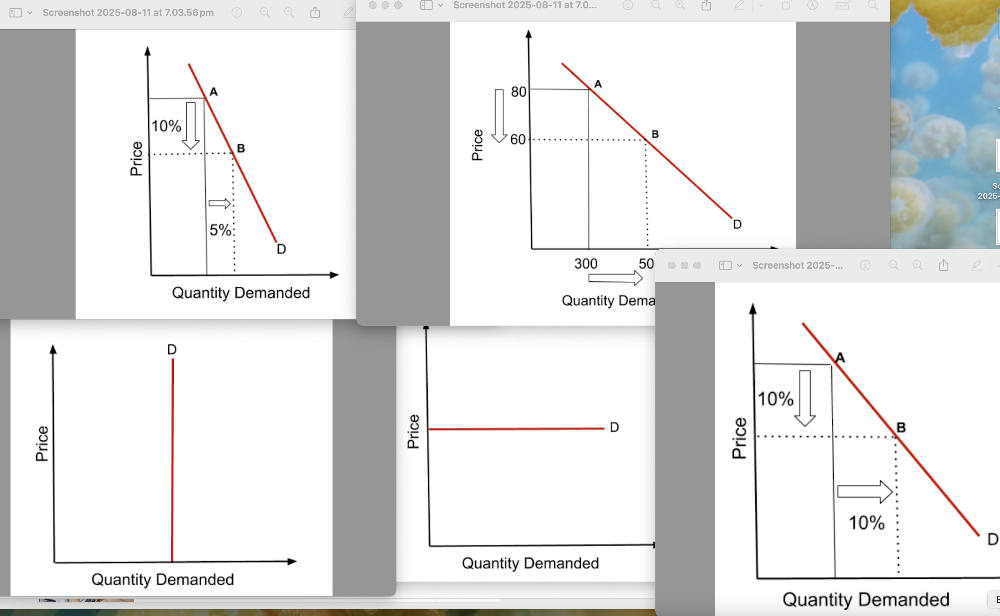

front 33 Definition of PED (Price Elasticity Of Demand) | back 33 A numerical measure of the responsiveness of the quantity demanded to changes in its price. PED (of a product) = % change in quantity demanded / % change in price. |

front 34 Types of PED (Price Elasticity Of Demand) | back 34  When the % change in quantity demanded is lesser than the % change in price, it is said to have a price inelastic demand. and vice versa. When the % change in demand and price are equal, that is value is 1, it is called unitary price elastic demand. When the price changes have no effect on demand whatsoever, it is said to have a perfect price inelastic demand. Their elasticity is 0. When the quantity demanded changes without any changes in price itself, it is said to have an infinitely price elastic demand. |

front 35 What effect PED and PES | back 35 PED: Number of substitutes, wether luxury or necessity, time it is increased for. PES:

|

front 36 Definition of PES (Price Elasticity Of Supply) | back 36 A numerical measure of the responsiveness of its quantity supplied it to changes in its price. PES of a product = %change in quantity supplied / % change in price. |

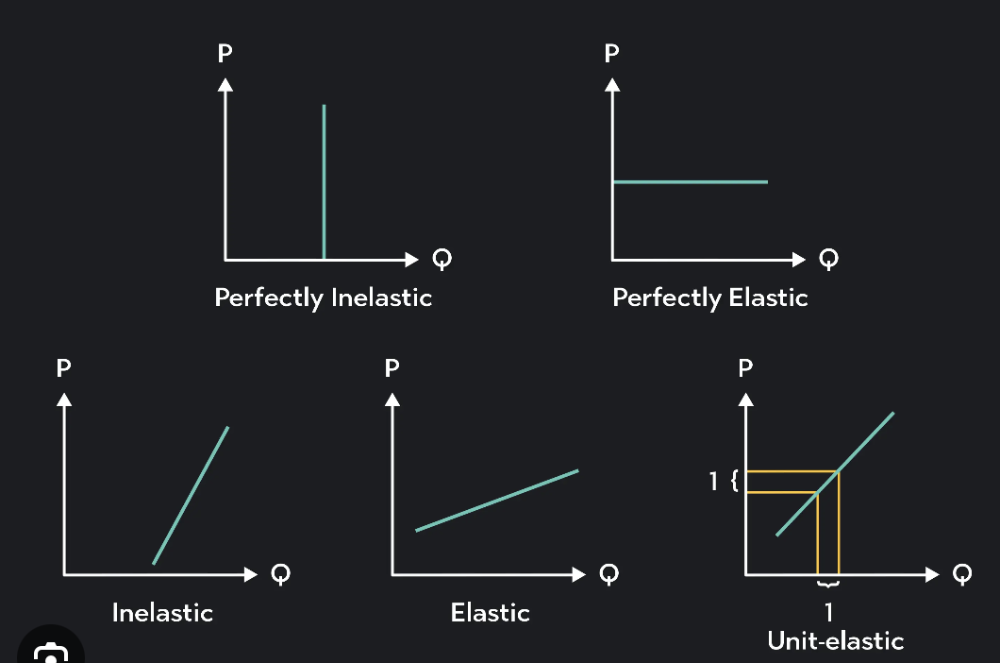

front 37 Types of PES (Price Elasticity Of Supply) | back 37  price elastic supply, price inelastic supply, perfectly price inelastic supply, infinitely price elastic supply and unitary price elastic supply. |

front 38 Definition of market economic system | back 38 An economy that has no government intervention in the allocation of resources and distribution of goods/services. |

front 39 The key terms associated with market failure: public good, merit good, demerit good, social benefits, external benefits, private benefits, social costs, external costs, private costs. definitions | back 39

|

front 40 Definition of the mixed economic system | back 40 A blend of a market economy and a planned economy, where the public and private sector all have a role in owning and allocating resources. |

front 41 Characteristics of money | back 41 Durable, portable, recognisable, identical, and dividable. |

front 42 Functions of money | back 42 -Medium of exchange (selling and buying) -Store of value (when saved) -Standard of deferred payments (allowing borrowing and spending) -Unit of account (measure of value of goods) |

front 43 Money definition and legal tender | back 43 Money - a universally accepted medium of exchange. Legal tender - Any form of payment that must be accepted by law to settle a debt. . |

front 44 The role and importance of central banks and commercial banks for government, producers and consumers. | back 44 Central Banks

Commercial Banks

|

front 45 factors affecting an individual’s choice of occupation : Wage and non-wage factors. | back 45 wage factors - higher pay, overpay, bonuses, commision Non wage - job satisfaction, type of work (manual, non-manual etc), work conditions, hours, holidays, pensions, fringe benefits, job security, prospect of promotion, size of firm, location |

front 46 wage determination | back 46 Demand and supply of labour in jobs, trade unions, minimum wage, discrimination, skilled workers and esteem of job. |

front 47 Advantages and disadvantages for workers, firms and the economy of specialisation | back 47 For Workers

For Firms

For the Economy

|

front 48 definition of a trade union | back 48 Trade Union is a group of workers who join together to protect their interests and work for better wages and working conditions using collective bargaining. |

front 49 the role of trade unions | back 49 Engaging in collective bargaining on wages, working hours and working conditions; protecting employment; and influencing government policy, take industrial action, provide training schemes. |

front 50 things effecting the role of trade unions | back 50 -Strong economy means industries are doing well so can afford to treat workers well, they will also require workers and there will be low unemployment so they will want to retain workers and make it easier to recruit more. -higher number of member, higher bargaining power, more funds and not many non-union member to replace union members with. -if contains high skilled members as harder to replace -consistent demand for product workers produce -favorable gov legislation |

front 51 The advantages and disadvantages of trade union activity for workers, firms and the government. | back 51 For Workers

For Firms

For the Government

|

front 52 internal and external economies and diseconomies of scale | back 52

|

front 53 The advantages and disadvantages of small firms, the challenges facing small firms and reasons for their existence. | back 53 Small firms thrive on close customer relationships, personalized services, and quick adaptability to market changes, offering unique products. However, they face challenges like limited financial resources, difficulty attracting experienced staff, intense competition from larger firms, and vulnerability to economic downturns. Small firms exist because of small market sizes, consumer preference for personalized services, owner preference for remaining small, lack of capital for expansion. |

front 54 Definition, example, and advantages and disadvantages of the three types of mergers. | back 54 Horizontal Merger

Vertical Merger

Conglomerate Merger

|

front 55 Factors that effect the demand for factors of production | back 55 Demand for the product, the price of different factors of production, their availability and their productivity. \ |

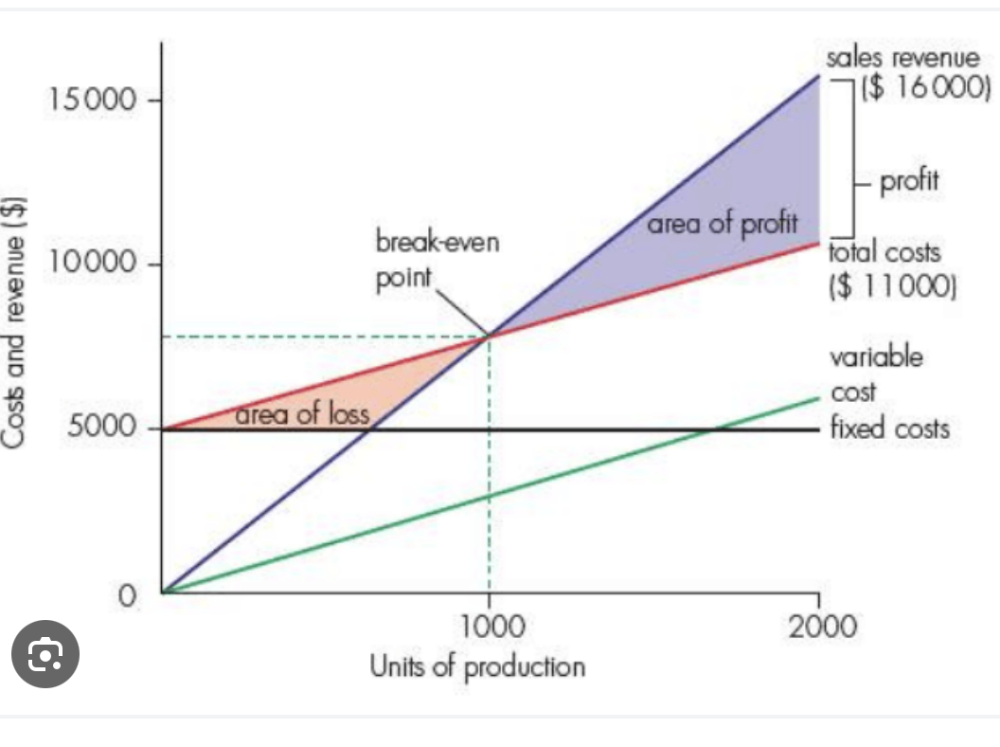

front 56 Total cost (TC), average total cost (ATC), fixed cost FC), variable cost (VC), average fixed cost (AFC), average variable cost (AVC) definition and calculations and diagram | back 56  Fixed costs (FC) are costs that do not change with the level of output. Variable costs (VC) are costs that change with output. Total cost (TC) is the combination of FC and VC. Average total cost (ATC) is TC divided by output, or total costs per unit of output. Average fixed cost (AFC) is FC divided by output, or fixed costs per unit of output. Average variable cost (AVC) is VC divided by output, or variable costs per unit of output. |

front 57 Total revenue (TR) and average revenue (AR) definition and calculations | back 57 Total Revenue (TR) is the total income a firm receives from selling all its output, calculated as Price × Quantity. Average Revenue (AR) is the revenue per unit sold, found by dividing Total Revenue by the quantity sold, meaning AR is equal to the price per unit. |

front 58 objectives of firms 4 | back 58 Survival, social welfare, profit maximisation and growth. |

front 59 Characteristics, advantages and disadvantages of a monopoly. | back 59

Advantages include economies of scale, potentially invest in innovation but disadvantages include higher prices, reduced choice, potential for inefficiency (X-inefficiency), and no consumer sovereignty. |

front 60 the role of government Locally, nationally and internationally. | back 60 At a local level, governments manage services like local infrastructure, sanitation, and housing to meet community needs. Nationally, they focus on macroeconomic goals such as controlling inflation, reducing unemployment, promoting economic growth, and ensuring social welfare through policies like taxes, subsidies, and infrastructure projects. Internationally, governments engage in diplomacy, negotiate trade agreements, provide foreign aid, and manage international trade through restrictions or open markets to foster global relations and economic stability. |

front 61 the macroeconomic aims of government. Reasons behind the choice of aims and the criteria that governments set for each aim. Possible conflicts between aims. | back 61 1. Economic Growth

2. Full Employment/Low Unemployment

3. Stable Prices/Low Inflation

4. Balance of Payments Stability

5. Redistribution of Income

Possible conflicts between aims: -full employment versus stable prices (as when low unemployment higher demand for workers so businesses may have to raise wages leading to inflation.) - economic growth versus balance of payments stability (Rapid economic growth can lead to increased imports and a trade deficit, as more demand and consumer disposable income.) -full employment versus balance of payments stability as (Policies to achieve full employment might lead to increased wages and costs, making exports less competitive and potentially worsening the balance of payments.) |

front 62 definition of the government budget | back 62 A financial plan outlining the government's expected revenue and planned expenditure for a specific period, usually one year. |

front 63 main areas of government spending and the reasons for and effects of spending in these areas. | back 63 Main government spending areas include public goods and merit goods, welfare and social protection, infrastructure, and debt interest payments. Reasons for spending are to correct market failures (like free riders and under-consumption), redistribute income, boost economic growth, and provide essential services. Spending effects include job creation, improved living standards, increased productivity, potential inflation, and changes in national debt. |

front 64 reasons for levying taxation | back 64

|

front 65 types of tax | back 65

|

front 66 The qualities of a good tax. The impact of taxation on consumers, producers, government and economy as a whole. | back 66

Consumers: Taxes raise prices, reduce disposable income, and influence buying behavior (e.g., discouraging harmful goods). Producers: Taxes increase production costs, reduce supply, lower profits, and may cause inefficiencies in markets. Government: Taxes provide revenue for public services, help stabilize the economy, redistribute income, and correct market failures. Economy as a Whole: Taxes affect economic activity, can either reduce or improve efficiency, and support social welfare through public goods and inequality reduction. |

front 67 definition of fiscal policy | back 67 Fiscal policy is a government policy which adjusts government spending and taxation to influence the economy. |

front 68 Calculating a Budget Deficit or Surplus: | back 68 Budget Deficit = Government Spending - Government Revenue opposite for surplus |

front 69 definition of money supply and monetary policy | back 69 The money supply is the amount of money in an economy at any given moment in time. Monetary policy is adjusting monetary policy measures like interest in order to influence the total demand in an economy. |

front 70 monetary policy measures and effects | back 70 Changes in interest rates, money supply and foreign exchange rates.

Exchange Rate Stability

|

front 71 definition of supply-side policy | back 71 Supply side policies are microeconomic policies aimed at increasing supply in the economy, |

front 72 supply-side policy measures and effects on government macroeconomic aims | back 72 Possible supply-side policy measures include: education and training, labour market reforms, lower direct taxes, deregulation, improving incentives to work and invest, and privatisation. 2. Labour Market Reforms:

3. Lower Direct Taxes:

4. Deregulation:

6. Privatisation:

|

front 73 definition of economic growth | back 73 The annual increase in the level of national output as measured by the gross domestic product (GDP). |

front 74 measurement of economic growth 2 GDP ones | back 74 Real Gross Domestic Product (GDP) is the value of all goods and services produced in a country annually, adjusted for inflation. Real GDP Growth Rate = Nominal GDP Growth Rate - Inflation Rate GDP per capita, calculated by dividing Real GDP by the total population, showing the average output or income per person. |

front 75 Meaning of recession | back 75 A recession occurs when an economy experiences two or more consecutive quarters of negative GDP growth |

front 76 The costs and benefits of economic growth | back 76 Benefits of Economic Growth

Costs of Economic Growth

|

front 77 policies to promote economic growth | back 77 demand-side policies, which boost total spending through fiscal (government spending and taxation) and monetary (interest rates and money supply) measures. supply-side policies, which improve the economy's productive capacity through education, training, deregulation, and investment incentives |

front 78 definition of employment, unemployment and full employment | back 78 Employment: the economic use of labour as a factor of production · Full Employment is the situation where the entire labour force is employed. That is, all the people who are able and willing to work are employed. A situation where people in the labour force who are able and willing to work are unemployed. |

front 79 How unemployment is measured and the formula for the unemployment rate. | back 79 (Number of Unemployed / Total Labour Force) x 100. Claimant Count : The number of people registered as officially unemployed and claiming unemployment benefits. Labour Force Survey (LFS) : A regular survey of households that asks a series of questions to classify people as employed, unemployed, or economically inactive, based on ILO criteria. |

front 80 causes/types of unemployment | back 80 Frictional Unemployment : (This is a natural, short-term form of unemployment) When people are temporarily between jobs or first entering the workforce. Structural Unemployment is caused by a long-term mismatch between the skills workers possess and the skills demanded by employers (often caused by development, or a mismatch between the worker's location and job availability.) Cyclical unemployment : Unemployment caused by a fall in the overall demand for goods and services, typically occurring during a recession or economic slowdown. |

front 81 The consequences of unemployment for the individual, firms and the economy as a whole. | back 81 Unemployment has negative consequences for individuals (loss of income, health issues, damaged self-esteem), firms (reduced sales, lower output, loss of skills), and the overall economy (lower GDP, decreased tax revenue, increased government spending on benefits, economic stagnation). |

front 82 definition of inflation and deflation | back 82 inflation is a sustained increase in the general price level of goods and services in an economy over time. Deflation is a sustained decrease in the general price level of goods and services in an economy over time. |

front 83 Measurement of inflation and deflation using the Consumer Prices Index (CPI). | back 83 Tracking the average change over time in the prices of a "basket" of consumer goods and services. new CPI - old CPI / old CPI x 100. A positive result indicates inflation, while a negative result signifies deflation. |

front 84 Causes of inflation | back 84 Demand-Pull Inflation: Occurs when the total demand for goods and services in an economy exceeds the total supply. Cost-Push Inflation: Occurs when the costs of producing goods and services rise. |

front 85 Causes of deflation | back 85 Demand-Side Deflation: Results from a general decrease in aggregate demand in the economy. Supply-Side Deflation: Occurs due to an increase in the overall supply of goods and services or a decrease in production costs. |

front 86 The range of policies available to control inflation and deflation | back 86

|

front 87 The consequences of inflation and deflation for consumers, workers, savers, lenders, firms and the economy as a whole. | back 87 Inflation (rising prices)

deflation

|

front 88 Real GDP per head and the Human Development Index (HDI), pros and cons | back 88 The Human Development Index (HDI) combines income, life expectancy, and education into a single score.

Real GDP per Head : The total value of goods and services produced in an economy, adjusted for inflation, and divided by the total population.

|

front 89 Reasons for differences in living standards and income distribution within and between countries. | back 89 Factors Within Countries,: Education and skills, different employment opportunities, government policies, Inheritance and wealth, Discrimination, Rural vs. Urban Divide due to varying access to services and economic opportunities. Factors Between Countries, Economic Structure: Countries with economies heavily reliant on the primary sector (agriculture) and a large proportion of the workforce in informal, low-wage jobs often have lower living standards. Economic Development & Technology, Natural Resources, Conflict, Crime, and Natural Disasters, Geographic Factors impact its ability to engage in trade, access markets, and experience economic growth. |

front 90 definition of absolute and relative poverty, how measured | back 90 Absolute poverty: the inability to afford basic necessities needed to live. It's measured by the number of people living below the poverty line. Relative Poverty is a situation where a person lacks the resources to maintain the average standard of living within their society. It's measured by a percentage of the national median income (e.g., less than 60% of the median). causes of poverty : including unemployment, low wages, illness and age. Policies include: promoting economic growth, improved education, more generous state benefits, progressive taxation, and national minimum wage. |

front 91 advantages and disadvantages of specialisation and reasons | back 91

|

front 92 definition of globalisation | back 92 Globalisation is the increased economic interconnectedness of countries through increasing cross-border movement of people, goods/services, technology and finance. |

front 93 multinational corporation definition | back 93 a business that has production facilities in two or more countries |

front 94 MNCs and the costs and benefits to home and host countries. | back 94 Impact on home country: Advantages:

Disadvantages :

Impact on host country Advantages:

Disadvantages:

|

front 95 the benefits of free trade or consumers, producers and the economy | back 95 Consumers: Lower prices, Greater variety, Higher quality. Producers: Expanded markets, Economies of scale, Lower costs: Producers can access cheaper raw materials and other production resources cheeper from other countries. Increased efficiency and innovation: Competition from foreign firms incentivises domestic companies to innovate. For the economy: Economic growth, Efficient resource allocation: Countries can specialise in producing goods where they have a comparative advantage, leading to more efficient use of global resources. Increased competition so higher efficiency and Higher incomes and living standards, Spread of technology and ideas. Stronger international relations. |

front 96 methods and reasons of protection | back 96 Tariffs are taxes on imported goods. Quotas limit the quantity of imports. Subsidies are government payments to domestic producers. Embargoes are complete bans on trade. To protect infant and declining industries, Strategic industries (industries that are considered crucial for a country's long-term economic growth or national security), and avoidance of dumping (when a company exports a product to another country at a price lower than its domestic market price or even below the cost of production leading to unfair competition). *improving a country's trade balance in the short term by making imports more expensive and less competitive. However, it often leads to higher consumer prices, reduced choice, and can provoke retaliatory measures from trading partners, potentially harming export competitiveness and increasing global trade friction. |

front 97 definition of foreign exchange rate and two systems | back 97 the price of one country's currency in terms of another country's currency Floating exchange rates are determined by market forces without government intervention, while fixed exchange rates are pegged to another currency by the government or central bank. Floating exchange rate Advantages

Disadvantages

Fixed exchange rate: Stability and predictability which promotes trade and investment. But Loss of monetary policy independence: The central bank must focus on maintaining the fixed rate, limiting its ability to use interest rates for other domestic economic goals. Requires large foreign reserves: The central bank needs to hold large reserves to intervene and defend the peg if necessary. Vulnerability to speculative attacks: If speculators believe a fixed rate is unsustainable, they can attack the currency, potentially causing a currency crisis. Difficult to adjust: It can be hard to adjust to external shocks, sometimes requiring difficult and painful economic restructuring or devaluation. |

front 98 causes of foreign exchange rate fluctuations | back 98 Changes in the demand for exports and imports

Changes in the rate of interest

Speculation

the entry or departure of MNCs. |

front 99 How change rate fluctuation impacts price of exports and imports. | back 99 A currency appreciation makes exports more expensive for foreign buyers and imports cheaper for domestic consumers, while a depreciation does the opposite. The total effect of these changes on the volume of spending depends on the price elasticity of demand (PED) |

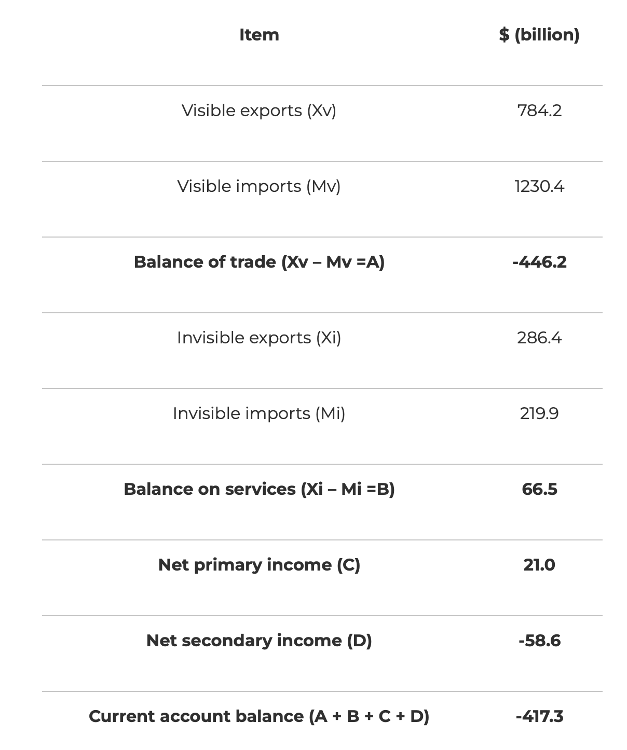

front 100 Current account of balance of payments structure and calculation | back 100  Trade in goods and services

|

front 101 Reasons for current account deficit and consequences | back 101 Causes of a current account deficit

Consequences of a current account deficit

|

front 102 Policies to achieve balance of payments stability | back 102 Policies to achieve balance of payments stability include exchange rate policies (A government can choose (devaluation) to devalue its currency to make exports cheaper and imports more expensive, thus improving the balance of payments or let it happen naturally from a current account deficit (Floating Exchange Rate) Fiscal and monetary policies to reduce national income and demand, This decreases spending on imports, which helps to improve the balance of payments deficit. Supply-side policies (to improve international competitiveness). |