Instructions for Side by Side Printing

- Print the notecards

- Fold each page in half along the solid vertical line

- Cut out the notecards by cutting along each horizontal dotted line

- Optional: Glue, tape or staple the ends of each notecard together

WI Assessor 2 Certification Exam

front 1 Property classification: Residential (1) RC-MAU-APO | back 1 untilled land not suitable for production of row crops and has a human abode Examples:

|

front 2 Property classification: Commercial (2) RC-MAU-APO | back 2 buying and reselling goods for a profit and providing services to other classes Examples:

|

front 3 Property classification: Manufacturing (3) RC-MAU-APO | back 3 anything used in the making/assembling/manufacturing of tangible personal property for profit Examples:

|

front 4 Property classification: Agricultural (4) RC-MAU-APO | back 4 production of crops & keeping of livestock without including any buildings or improvements Examples:

|

front 5 Property classification: Undeveloped (5) RC-MAU-APO | back 5 land that does not produce and is not capable of producing Examples:

|

front 6 Property classification: Agricultural Forest (5m) RC-MAU-APO | back 6 productive forest but needs to be next to 100% AG land, be within AG land from 2004, or be within converted land from 2005 or later that is 50% or more AG |

front 7 Property classification: Productive Forest (6) RC-MAU-APO | back 7 land producing or is capable (even if no current commercial use) of producing commercial forest products Examples:

|

front 8 Property classification: Other (7) RC-MAU-APO | back 8 land required for improvements on AG land |

front 9 What property classifications are assessed at full value? | back 9 residential, commercial, manufacturing, productive forest, & Other |

front 10 What property classifications are assessed at 50% of full value | back 10 undeveloped & agricultural forest |

front 11 What property classification is assessed at use-value | back 11 Agricultural |

front 12 Asking price of property owners generally establishes the ______ of value

| back 12 upper limit when property owners are listing their sale, we can assume they want the full market value which can be seen as the Upper Limit of the property value

|

front 13 Offering price by buyers normally establishes the ______ of value

| back 13 lower limit when buyers are first offering a price for the property it will be lowest price they believe the property owners will think the sale is worth. This will be lower than the asking price (upper limit) and can be seen as the Lower Limit for the property value

|

front 14 An agreement which permits one to buy, sell, or lease a property within a stipulated period of time is known as a (an) ______

| back 14 option WPAM chapter 9 "With an option contract the property owner gives a prospective purchaser the right to buy a property at a specified price within a given period of time." Key here is the stipulated period of time

|

front 15 ______ capitalization is a method of converting future net benefits into present value where each future net benefit is discounted at a proper yield rate (present worth factor)

| back 15 yield WPAM chapter 9 & 13 Key here is each future net benefit is discounted at a proper yield rate Think of matching the words YIELD and combining EACH net benefit, not just a year's worth

|

front 16 The best source for verification or documentation of sales data is ______

| back 16 direct interview of the buyer or seller

|

front 17 Comparable sale properties should be visually inspected to enable the assessor to make an accurate analysis of the sales and reflect the dissimilarities existing between the comparable sales and the subject property by means of the ______

| back 17 adjustments WPAM chapter 9, Sales Comparison Approach key here is reflect dissimilarities existing between the comparable sales and the subject property |

front 18 Straight line capitalization assumes a (an) ______ income stream during the remaining economic life of the improvements

| back 18 declining |

front 19 Appropriate units of comparison for the valuation of vacant land are all of the following except

| back 19 neighborhood WPAM Chapter 12, Units of Comparison You can value parcels based on neighborhoods but it is not a Unit of Comparison |

front 20 The formula for a developing a gross income multiplier is

| back 20 GIM = sales price/gross income WPAM chapter 9, Gross Rent Multiplier Gross Rent or Gross Income Multiplier (GRM/GIM) It is asking you to find a formula to figure out how many years of the yearly income fits into the sale price |

front 21 Appropriate units of comparison for the valuation of apartment houses are

| back 21 apartment unit, apartment room, square ft. of building, gross rent multiplier WPAM Chapter 12, Units of Comparison Analyzing the answer options, you'll notice all the answers are the same except the last item in the list so we just need to find which last list item is the best unit of comparison for valuing apartments

|

front 22 Adjustments in the comparable sales approach are always made to the ______

| back 22 sale (comparable property) WPAM chapter 12, Adjustment Process "By modifying the sale prices of comparable properties to reflect the characteristics of the subject, the assessor can estimate the value of the subject property." |

front 23 The ______ rate is another name for the return ______ the investment

| back 23 discount, on WPAN chapter 11, Income Approach

"The capitalization rate is composed of three different

rates: |

front 24 The adjustment process involves the application of the ______ of an item (or factor) to the total property

| back 24 contributory value WPAM chapter 12, Adjustment Process "The principle of contribution is the underlying principle in the adjustment process. The assessor must determine what a particular feature contributes to the value of the property as a whole, i.e., how much more or less would a purchaser typically pay for a property with or without a certain characteristic." |

front 25 Elements for which adjustments can be made are

| back 25 time, location, physical condition, size, components, and soil productivity WPAM chapter 12, Adjustment Process "Characteristics for which adjustments are typically made include time of sale, location, and physical factors." Key here is knowing TIME is the most important adjustment, if the answer doesn't include Time as one of the options then it is automatically wrong. From there you can see physical factors is only in the first option making it the best answer |

front 26 The correlating of the value indications of the various sales into a single indicator of value is known as ______

| back 26 reconciliation Key here is into a single indicator this connects most with the word reconciliation |

front 27 When plus or minus adjustments are expressed in terms of percentages, the adjustment for ______ should be made prior to any other adjustments

| back 27 time WPAM chapter 12, Adjustment Process "In general, sales are first adjusted for time to reflect the sale price as of the appraisal date. All other adjustments are made to the time adjusted sale price." |

front 28 Capitalization may be described as

| back 28 conversion of future income stream to present worth |

front 29 An improved property is valued at $50,000. The building-land ratio is 4:1. By allocation, what is the estimated land value?

| back 29 $10,000 You are given the building to land ratio which says the land is valued at 1/4 of the building. Land Value = Property Value * Land Ratio 50,000 x 0.25 = $12,500 We can assume because it's an estimated value we can go to the closest answer which is 10,000 |

front 30 What are the four government rights to a property? | back 30 Taxation, Escheat, police power, Eminent Domain |

front 31 Who appoints the real property lister? | back 31 County board or administrator |

front 32 Who is responsible for the discovery of property and omitted? | back 32 The assessor |

front 33 When is the last day the personal property forms can be delivered back to the assessor? | back 33 March 1 |

front 34 How far back can the assessor assess omitted property? | back 34 2 years |

front 35 How far back can the assessor go to pick up assessment errors? | back 35 1 year |

front 36 What is the three main function of the assessment process? | back 36 Discovery, Listing, valuation |

front 37 What must be listed if the parcel is greater than one tract? | back 37 The number of acres in each tract |

front 38 Who can order an Assessors plat? | back 38 The local governing body |

front 39 Who may end up paying for the Assessors plat? | back 39 The affected land owners |

front 40 The authority to levy taxes is granted to all taxing districts by: | back 40 The State Legislature |

front 41 The requirement of uniformity of taxation is a mandate from: | back 41 The State Constitution |

front 42 The state legislature is solely responsible for: | back 42 Establishing the criteria for exemptions |

front 43 The local tax rate is determined by dividing: | back 43 the Levy by the total assessed value of the district |

front 44 All real property shall be assessed as of: | back 44 The close of business Jan 1 of each year |

front 45 State law (sec. 70.32(2)(c)1d, Wis. Stats.), defines agricultural

forest as land that is capable of producing commercial | back 45 20 years (from 2004) |

front 46 The only evidence that may properly be used by the board of review is: | back 46 Evidence given orally under oath at the board of review hearing |

front 47 As assessment quality improves, the: | back 47 Property tax collections remain the same |

front 48 How many classes of real property are there? | back 48 eight |

front 49 How is non-agricultural real estate to be valued: | back 49 Based on market value by sale |

front 50 Explain the difference between market value and true cash value? | back 50 No difference, they are the same |

front 51 When does the assessor sign the affidavit/roll? | back 51 On or before the first Monday in may prior to the BOR |

front 52 If the affidavit/roll is unsigned? | back 52 Still valid not a nullity, burden on municipality |

front 53 What constitutes a quorum? | back 53 A majority constitutes a quorum except that 2 members may hold a hearing of evidence required. If two were at the hearing than another member must review the transcript and then the 3 will decide. |

front 54 Time and place of BOR meeting: | back 54 Shall meet annually at any time during a 30 day period beginning the second Monday in May. At least 15 days before the first session the clerk of the BOR must publish a first class notice and place a notice in at least 3 public places and place a notice on the door of the town hall, village hall or council chambers at city hall of the time and place of the first meeting. |

front 55 What if the BOR has to adjourn? | back 55 If an adjournment be had for more than one day, a written notice shall be posted on the outer door of the place of said meeting, stating to what time said meeting adjourned. |

front 56 True or False: Metes and bounds descriptions are always tied to a known point | back 56 True |

front 57 True or False: Metes and bounds must be read from the beginning and followed through while the rectangular survey descriptions are read backwards: | back 57 True |

front 58 What is Metes and Bounds? | back 58 A means of describing land by starting from a known point and following the outside boundaries of the parcel |

front 59 True or False: The income approach derives an expression of present worth by converting future benefits into a market value. | back 59 True |

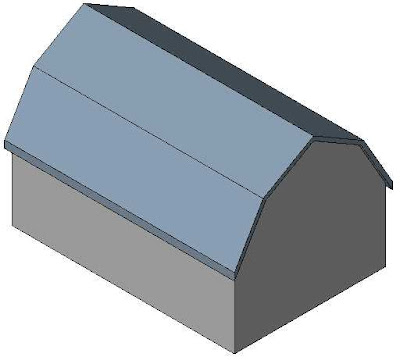

front 60

| back 60 Hip Angled/sloping sides that meet at a hip (edge) |

front 61

| back 61 Gambrel 2 different angles of slopes (smaller angle & bigger angle) that meet at top hip (edge) |

front 62

| back 62 Mansard 4 sloped sides with steep angles meeting at a flat top (hip with a flat top) gives extra room in the house and translate to increase in value |

front 63 bad paint job or leaky roof

| back 63 physical deterioration, short life, curable |

front 64 roof framing

| back 64 physical deterioration, long life, curable |

front 65 inharmonious land use or population changes

| back 65 economical obsolescence, N/A, uncurable |

front 66 old-fashioned plumbing fixtures

| back 66 functional obsolescence, N/A, curable |

front 67 bad floor plan/layout

| back 67 functional obsolescence, N/A, incurable |

front 68 foundation or bearing walls need replacing/are faulty

| back 68 physical deterioration, long-life, incurable |

front 69 all kitchen appliances are old/worn and will cost more than added value

| back 69 physical deterioration, short life, incurable |

front 70 what class of depreciation does Condition (CDU) connect with?

| back 70 physical deterioration |

front 71 what class of depreciation does Desirability (CDU) connect with?

| back 71 economic obsolescence |

front 72 what class of depreciation does Usefulness (CDU) connect with?

| back 72 functional obsolescence |

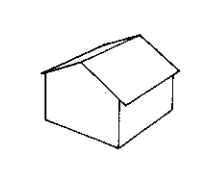

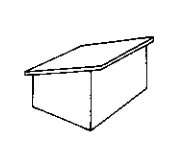

front 73 If a property's depreciation is at 60%, what is the Percent Good?

| back 73 40% Percent good is the other half of depreciation, 60 and 40 come together to make a whole |

front 74  | back 74 gable |

front 75  | back 75 shed/single pitch |

front 76 what's the difference between live load and dead load? | back 76 dead load is the weight of the building and all permanent objects while the live load includes the weight of occupants and anything removable with the building weight |

front 77 what action does plottage describe?

| back 77 combining 2 lots into 1 to have a greater singular value |

front 78 process of creating/improving land from flooded areas | back 78 reclamation |

front 79 What are the 5 rights a property owner must have to claim Fee Simple Ownership Interest? (S, L&O, M, G, all or nothing) | back 79

|

front 80 Which government limitation goes with this definition? power to take property title if owner dies without an heir | back 80 Escheat |

front 81 Which government limitation goes with this definition? power to take property for public use with owner being compensated | back 81 Eminent Domain |

front 82 Which government limitation goes with this definition? right to regulate use of property | back 82 Police Power |

front 83 Which government limitation goes with this definition? power to tax property | back 83 Taxation |

front 84 one-story house that usually has an attached garage and a large picture window facing the street. The shape of the house is either rectangular or an "L" or "U" shape. The houses have low-pitched roofs and extended eaves (edge of roof) | back 84 Ranch |

front 85 a one-story house with a full basement at half grade. The partially excavated basement typically has daylight windows in the lower level. The two levels are split by a foyer at grade level | back 85 Bi-level (raised ranch) |

front 86 living areas staggered on two or more levels, separated by one half grade. There are typically two or more short sets of stairs running up or down and have a split roof design | back 86 Split-level |

front 87 A one story with attic or a one and one-half story house with dormers, extra gables, or shed dormers, generally built after the 1920's. It is characterized by a steep roof slope and dormers which project from the roof and have windows on their fronts | back 87 Cape cod |

front 88 one-story house, often with finished attic area, popular in the early

20th century, and generally built from 1905 to 1930. This style has

one or more low-pitched overhanging gables, and is characterized by

exposed beams, projecting brackets, and use of natural materials.

Porches usually extend across the front and are supported by wide

columns. Windows are generally casement or double | back 88 bungalow |

front 89 small, plain single family house. It is usually one story built with minimum construction standards resulting in narrow boxy exterior appearance with little or no ornamentation & low pitch roof | back 89 cottage |

front 90 constructed of mixed natural materials (wood, stone, and brick) with lowpitched roofs, wide eaves, and exposed brackets. Most homes of this style have porches with thick round or tapered square columns. The style is generally symmetrical with double hung windows and multi-gables or hipped roofs | back 90 craftsman |

front 91 low pitched roofs, generally gabled and enclosed, often with hip or flat roofs. Boxy and low-proportioned with strong horizontal lines and oversized eaves | back 91 Prairie |

front 92 built between 1900 and 1950 that is typically built at a quality grade less than C. It has a simple design that often includes only a single bathroom and has small bedrooms. It often includes an unfinished attic and an unfinished basement | back 92 basic single story |

front 93 multi-story style with large front porches or wraparound decks and have gable roofs that may cover the porch. They are minimally ornamental and have large windows to bring in light. The exterior is faced with horizontal siding and the homes often have a simple rectangular floor plan with side wings | back 93 farmhouse |

front 94 from the 19th century, asymmetrical, two + stories with steep roof

pitches which may include turrets and dormers. Large porches are

embellished with decorative | back 94 victorian |

front 95 rectangular shaped two-story home. Each floor is two rooms deep, and has approximately the same square footage. The roof structure has a medium slope, with limited attic space that is not intended for living area | back 95 colonial |

front 96 modern style, single or multi-story and may be of split level construction. Houses typically incorporate tall, irregularly shaped windows, open planning and angular exterior lines. Roofs may be flat, shed, gable or various combinations thereof | back 96 contemporary |

front 97 single story, high ceilings, and moderate to steep pitched hip or multi-gabled roof. Windows are large and abundant, permitting extensive natural light. Prominent garages with 3-4 stalls are common. | back 97 modern single story |

front 98 Prominent 3-4 stall garages, and a mix of exterior wall coverings are common in this style. Features include tall entrance ways, abundant large windows, and high ceilings | back 98 modern multi-story |

front 99 A large, luxury home built using the highest quality materials of brick or cut stone. These homes commonly have three or more baths, two or more fireplaces, and expansive entries with elaborate open stairways. These largescale homes are typically 4,000 to 12,000 square feet per story, and are often located in prestigious neighborhoods | back 99 executive mansion |

front 100 A form of fee ownership of whole units or separate portions of multi-unit buildings by statute, which provides the mechanics and facilities for formal filing and recording of a divided interest in real property, where the division is vertical as well as horizontal. Fee ownership of units in a multi- unit property and joint ownership of the common areas. | back 100 condo |

front 101 Any two-unit residence not qualifying as a townhouse, built after the mid-20th century | back 101 duplex |

front 102 A building containing multiple self-contained living units | back 102 apartment |

front 103 Recapture rate formula | back 103 annual amount recaptured / amount of original investment |

front 104 how to calculate remaining economic life of property | back 104 economic life - effective age Economic life: 50 years Effective age: 20 years 50-20 = 30 |

front 105 how to calculate depreciation ratio & apply it | back 105 effective age / economic life then multiplied against the Cost New Economic life: 50 years Effective age: 20 years Cost New: 100,000 20 / 50 = 0.40 --> 40% 100,000 x 0.4 = 40,000 The house has depreciated by 40,000 so we would subtract that |

front 106 What type of expenses should and should not be included when calculating income approach's net income? | back 106 Good: management, repairs, utilities, insurance Bad: mortgage interest or debt service, depreciation, capital expenses |

front 107 how many hours of CE are needed for recertification? | back 107 30 |

front 108 What day does the municipalities assessment need to be complete (other than 1st and 2nd class cities)?

| back 108 1st Monday of April |

front 109 When should the assessment roll be delivered to the clerk?

| back 109 1st Monday of May |

front 110 When does the BOR meet?

| back 110 4th Monday of April starts up a 45 day period BUT cannot be sooner than 7 days after open book |

front 111 When is the MAR report due to DOR?

| back 111 2nd Monday of June |

front 112 how many acres in 1 square mile? | back 112 60 |

front 113 how many miles is one township on each side? | back 113 6 |