Instructions for Side by Side Printing

- Print the notecards

- Fold each page in half along the solid vertical line

- Cut out the notecards by cutting along each horizontal dotted line

- Optional: Glue, tape or staple the ends of each notecard together

Financial Markets & Inst. - Test 1

front 1 The price of one country's currency in terms of another's is called | back 1 the foreign exchange rate. |

front 2 A security | back 2 is a claim on the issuers future income. |

front 3 _______ is the total resources owned by an individual, including all assets. | back 3 Wealth |

front 4 The money market is the market in which ________ are traded. | back 4 short-term debt instruments |

front 5 A coupon bond pays the owner of the bond | back 5 a fixed interest payment every period, plus the face value of the bond at the maturity date. |

front 6 Factors that cause the demand curve for bonds to shift to the left include | back 6 -a decrease in the volatility of stock prices.

|

front 7 In a recession when income and wealth are falling, the demand for bonds ________ and the demand curve shifts to the ________. | back 7 falls; left |

front 8 Diversification benefits an investor by | back 8 reducing risk. |

front 9 A $10,000, 8 percent coupon bond that sells for $10,100 has a yield to maturity | back 9 less than 8 perfect |

front 10 An $8,000 coupon bond with a $400 annual coupon payment has a coupon rate of | back 10 5 percent. |

front 11 Financial markets and institutions | back 11 -involve the movement of huge quantities of money.

|

front 12 (I) A bond is a debt security that promises to make payments periodically for a specified period of time. (II) A stock is a security that is a claim on the earnings and assets of a corporation. | back 12 Both are true. |

front 13 The stock market is important because | back 13 it is the most widely followed financial market in the United States. |

front 14 Holding everything else constant, an increase in wealth lowers the quantity demanded of an asset. | back 14 False. |

front 15 What is the return on a 5 percent coupon bond that initially sells for $1,000 and sells for $1,200 one year later? | back 15 25 percent |

front 16 When the lender and the borrower have different amounts of information regarding a transaction, ________ is said to exist. | back 16 asymmetric information |

front 17 Monetary policy is chiefly concerned with | back 17 the level of interest rates and the nation's money supply. |

front 18 Which of the following financial intermediaries are depository institutions? | back 18 -commercial bank

|

front 19 Interest rates are important to financial institutions since an interest rate increase ________ the cost of acquiring funds and ________ the income from assets. | back 19 increases; increases |

front 20 Bonds that are sold in a foreign country and are denominated in that country's currency are known as | back 20 foreign bonds. |

front 21 Factors that can cause the supply curve for bonds to shift to the right include | back 21 an expansion in overall economic activity. |

front 22 Markets in which funds are transferred from those who have excess funds available to those who have a shortage of available funds are called | back 22 financial markets. |

front 23 The efficient market hypothesis | back 23 -is based on the assumption that prices of securities fully reflect all available information.

|

front 24 (I) Banks are financial intermediaries that accept deposits and make loans.

| back 24 (I) is true, (II) false. |

front 25 Which of the following $1,000 face value securities has the highest yield to maturity? | back 25 A 12 percent coupon bond selling for $1,000 |

front 26 According to the efficient market hypothesis, the current price of a financial security | back 26 fully reflects all available relevant information. |

front 27 Bonds with relatively high risk of default are called | back 27 junk bonds. |

front 28 Financial market activities affect | back 28 -the economy's location in the business cycle.

|

front 29 The price paid for the rental of borrowed funds (usually expressed as a percentage of the rental of $100 per year) is commonly referred to as the | back 29 interest rate. |

front 30 The efficient market hypothesis suggests that allocating your funds in the financial markets on the advice of a financial analyst | back 30 is not likely to prove superior to a strategy of making selections by throwing darts at the financial page. |

front 31 Dollars received in the future are worth ________ than dollars received today. The process of calculating what dollars received in the future are worth today is called ________. | back 31 less; discounting |

front 32 Which of the following are generally true of all bonds? | back 32 -Prices and returns for long-term bonds are more volatile than those for shorter-term bonds.

|

front 33 If a $5,000 coupon bond has a coupon rate of 13 percent, then the coupon payment every year is | back 33 $650. |

front 34 Which of the following is not a regulator of part of the U.S. financial system? | back 34 -Federal Reserve System

|

front 35 An investor gains from short selling by ________ and then later ________. | back 35 selling a stock; buying it back at a lower price |

front 36 The concept of ________ is based on the notion that a dollar paid to you in the future is less valuable to you than a dollar today. | back 36 present value |

front 37 The organization responsible for the conduct of monetary policy in the United States is the | back 37 Federal Reserve System. |

front 38 When the price of a bond is above the equilibrium price, there is excess ________ in the bond market and the price will ________. | back 38 supply; fall |

front 39 Which of the following can be described as involving direct finance? | back 39 -An insurance company buys shares of common stock in the over-the-counter markets.

|

front 40 A $10,000, 8 percent coupon bond that sells for $10,000 has a yield to maturity of | back 40 8 percent. |

front 41 Which of the following long-term bonds should have the highest interest rate? | back 41 Corporate Baa bonds |

front 42 When the potential borrowers who are the most likely to default are the ones most actively seeking a loan, ________ is said to exist. | back 42 adverse selection |

front 43 ________ are an example of a financial institution. | back 43 -Insurance companies

|

front 44 To say that stock prices follow a "random walk" is to argue that | back 44 stock prices are, for all practical purposes, unpredictable. |

front 45 The efficient market hypothesis suggests that | back 45 -investors should not try to outguess the market by constantly buying and selling securities.

|

front 46 The government regulates financial markets for two main reasons: | back 46 to ensure soundness of the financial system and to increase the information available to investors. |

front 47 The current yield on a coupon bond is the bond's ________ divided by its ________. | back 47 annual coupon payment; price |

front 48 Factors that determine the demand for an asset include changes in the | back 48 -wealth of investors.

|

front 49 If Moody's or Standard and Poor's downgrades its rating on a corporate bond, the demand for the bond ________ and its yield ________. | back 49 decreases; increases |

front 50 ________ bonds are exempt from federal income taxes. | back 50 Municipal |

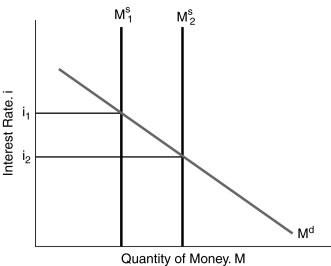

front 51  In Figure 4.3, the factor responsible for the decline in the interest rate is | back 51 an increase in the money supply. |

front 52 (I) Debt markets are often referred to generically as the bond market.

| back 52 (I) is true, (II) false. |

front 53 The purpose of diversification is to | back 53 reduce the volatility of a portfolio's return. |

front 54 The change in the bond's price relative to the initial purchase price is | back 54 rate of capital gain. |

front 55 A credit market instrument that pays the owner the face value of the security at the maturity date and nothing prior to then is called a | back 55 discount bond. |

front 56 The nominal interest rate minus the expected rate of inflation | back 56 -is a more accurate indicator of the tightness of credit market conditions than the nominal interest rate.

|

front 57 A corporation acquires new funds only when its securities are sold in the | back 57 primary market by an investment bank. |

front 58 Which of the following can be described as involving indirect finance? | back 58 -A corporation takes out loans from a bank.

|

front 59 Which of the following are primary markets? | back 59 (None of the above)

|

front 60 With an interest rate of 10 percent, the present value of a security that pays $1,100 next year and $1,460 four years from now is approximately | back 60 $2,000. |

front 61 Bonds with relatively low risk of default are called | back 61 investment-grade bonds. |

front 62 A stronger dollar benefits ________ and hurts ________. | back 62 American consumers; American businesses |

front 63 Bonds that are sold in a foreign country and are denominated in a currency other than that of the country in which they are sold are known as | back 63 Eurobonds. |

front 64 Another way to state the efficient market condition is that in an efficient market, | back 64 unexploited profit opportunities will be quickly eliminated. |

front 65 In which of the following situations would you prefer to be making a loan? | back 65 The interest rate is 4 percent and the expected inflation rate is 1 percent. |

front 66 The bond markets are important because | back 66 they are the markets where interest rates are determined. |

front 67 Which of the following statements about financial markets and securities are true? | back 67 -Money market securities are usually more widely traded than longer-term securities and so tend to be more liquid.

|

front 68 Financial markets have the basic function of | back 68 bringing together people with funds to lend and people who want to borrow funds. |

front 69 How expectations are formed is important because expectations influence | back 69 -the demand for assets.

|

front 70 A person who is risk averse prefers to hold assets that are more, not less, risky. | back 70 False |