1. You put up $50 at the beginning of the year for an investment. The value of the investment grows 4% and you earn a dividend of $3.50. Your HPR was ____.

4%

3.5%

7%

D. 11%

D

The ______ measure of returns ignores compounding.

geometric average

arithmetic average

IRR

dollar-weighted

B

If you want to measure the performance of your investment in a fund, including the timing of your purchases and redemptions, you should calculate the __________.

geometric average return

arithmetic average return

dollar-weighted return

index return

C

Which one of the following measures time-weighted returns and allows for compounding?

A. geometric average return

B. arithmetic average

return

C. dollar-weighted return

D. historical average return

A

5. Rank the following from highest average historical return to lowest average historical return from 1926 to 2013.

I. Small stocks

II. Long-term bonds

III. Large stocks

IV. T-bills

I, II, III, IV

III, IV, II, I

I, III, II, IV

III, I, II, IV

C

6. Rank the following from highest average historical standard deviation to lowest average historical standard deviation from 1926 to 2013.

Small stocks

II. Long-term bonds III. Large stocks IV. T-bills

I, II, III, IV

III, IV, II, I

I, III, II, IV

III, I, II, IV

C

You have calculated the historical dollar-weighted return, annual geometric average return, and annual arithmetic average return. If you desire to forecast performance for next year, the best forecast will be given by the ________.

dollar-weighted return

geometric average return

arithmetic average return

index return

C

The complete portfolio refers to the investment in _________.

the risk-free asset

the risky portfolio

the risk-free asset and the risky portfolio combined

the risky portfolio and the index

C

You have calculated the historical dollar-weighted return, annual geometric average return, and annual arithmetic average return. You always reinvest your dividends and interest earned on the portfolio. Which method provides the best measure of the actual average historical performance of the investments you have chosen?

A. dollar-weighted return

B. geometric average return

C.

arithmetic average return

D. index return

B

10. The holding period return on a stock is equal to _________.

the capital gain yield over the period plus the inflation rate

the capital gain yield over the period plus the dividend yield

the current yield plus the dividend yield

the dividend yield plus the risk premium

B

Your timing was good last year. You invested more in your portfolio right before prices went up, and you sold right before prices went down. In calculating historical performance measures, which one of the following will be the largest?

A. dollar-weighted return

B. geometric average return

C.

arithmetic average return

D. mean holding-period return

A

12. Published data on past returns earned by mutual funds are required to be ______.

dollar-weighted returns

geometric returns

excess returns

index returns

B

13. The arithmetic average of -11%, 15%, and 20% is ________.

15.67%

8%

11.22%

D. 6.45%

B

14. The geometric average of -12%, 20%, and 25% is _________.

8.42%

11%

9.7%

D. 18.88%

C

15. The dollar-weighted return is the _________.

difference between cash inflows and cash outflows

arithmetic average return

geometric average return

internal rate of return

D

An investment earns 10% the first year, earns 15% the second year, and loses 12% the third year. The total compound return over the 3 years was ______.

41.68%

11.32%

3.64%

13%

B

17. Annual percentage rates can be converted to effective annual rates by means of the following formula:

[1 + (APR/n)]n - 1

(APR)(n)

(APR/n)

(periodic rate)(n)

A

18. Suppose you pay $9,700 for a $10,000 par Treasury bill maturing in 3 months. What is the holding-period return for this investment?

3.01%

3.09%

12.42%

D. 16.71%

B

19. Suppose you pay $9,800 for a $10,000 par Treasury bill maturing in 2 months. What is the annual percentage rate of return for this investment?

2.04%

12 %

12.24%

D. 12.89%

C

20. Suppose you pay $9,400 for a $10,000 par Treasury bill maturing in 6 months. What is the effective annual rate of return for this investment?

6.38%

12.77%

C. 3.17%

D. 14.25%

C

21. You have an APR of 7.5% with continuous compounding. The EAR is _____.

7.5%

7.65%

7.79 %

D. 8.25%

C

22. You have an EAR of 9%. The equivalent APR with continuous compounding is _____.

8.47%

8.62%

8.88%

D. 9.42%

B

23. The market risk premium is defined as __________.

A. the difference between the return on an index fund and the

return on Treasury bills

B. the difference between the return on

a small-firm mutual fund and the return on the Standard & Poor's

500 Index

the difference between the return on the risky asset

with the lowest returns and the return on Treasury bills

the difference between the return on the highest-yielding asset and the return on the lowest-yielding asset

A

24. The excess return is the _________.

rate of return that can be earned with certainty

rate of return in excess of the Treasury-bill rate

rate of return to risk aversion

index return

B

The rate of return on _____ is known at the beginning of the holding period, while the rate of return on ____ is not known until the end of the holding period.

risky assets; Treasury bills

Treasury bills; risky assets

excess returns; risky assets

index assets; bonds

B

26. The reward-to-volatility ratio is given by _________.

the slope of the capital allocation line

the second derivative of the capital allocation line

the point at which the second derivative of the investor's indifference curve reaches zero

the portfolio's excess return

A

Your investment has a 20% chance of earning a 30% rate of return, a 50% chance of earning a 10% rate of return, and a 30% chance of losing 6%. What is your expected return on this investment?

12.8%

11%

8.9%

D. 9.2%

D

Your investment has a 40% chance of earning a 15% rate of return, a 50% chance of earning a 10% rate of return, and a 10% chance of losing 3%. What is the standard deviation of this investment?

5.14%

7.59%

9.29%

D. 8.43%

A

29. During the 1926-2013 period the geometric mean return on small-firm stocks was ______.

5.31%

5.56%

9.34%

11.82%

D

30. During the 1926-2013 period the geometric mean return on Treasury bonds was _________.

5.07%

5.56%

9.34%

11.43%

A

31. During the 1926-2013 period the Sharpe ratio was greatest for which of the following asset classes?

A. small U.S. stocks

B. large U.S. stocks

C. long-term

U.S. Treasury bonds

D. bond world portfolio return in U.S. dollars

B

32. During the 1986-2013 period, the Sharpe ratio was lowest for which of the following asset classes?

A. small U.S. stocks

B. large U.S. stocks

C. long-term

U.S. Treasury bonds

D. equity world portfolio in U.S. dollars

C

33. During the 1926-2013 period which one of the following asset classes provided the lowest real return?

Small U.S. stocks

Large U.S. stocks

Long-term U.S. Treasury bonds

Equity world portfolio in U.S. dollars

C

34. Both investors and gamblers take on risk. The difference between an investor and a gambler is that an investor _______.

is normally risk neutral

requires a risk premium to take on the risk

knows he or she will not lose money

knows the outcomes at the beginning of the holding period

B

35. Historical returns have generally been __________ for stocks of small firms as (than) for stocks of large firms.

the same

lower

higher

none of these options (There is no evidence of a systematic relationship between returns on small-firm stocks and returns on large-firm stocks.)

C

Historically, small-firm stocks have earned higher returns than large-firm stocks. When viewed in the context of an efficient market, this suggests that ___________.

small firms are better run than large firms

government subsidies available to small firms produce effects that are discernible in stock market statistics

small firms are riskier than large firms

small firms are not being accurately represented in the data

C

37. In calculating the variance of a portfolio's returns, squaring the deviations from the mean results in:

I. Preventing the sum of the deviations from always equaling zero

II. Exaggerating the effects of large positive and negative deviations

A number for which the unit is percentage of returns

I only

I and II only

I and III only

I, II, and III

B

If you are promised a nominal return of 12% on a 1-year investment, and you expect the rate of inflation to be 3%, what real rate do you expect to earn?

5.48%

8.74%

9%

D. 12%

B

If you require a real growth in the purchasing power of your investment of 8%, and you expect the rate of inflation over the next year to be 3%, what is the lowest nominal return that you would be satisfied with?

3%

8%

11%

D. 11.24%

D

40. One method of forecasting the risk premium is to use the _______.

coefficient of variation of analysts' earnings forecasts

variations in the risk-free rate over time

average historical excess returns for the asset under consideration

average abnormal return on the index portfolio

C

Treasury bills are paying a 4% rate of return. A risk-averse investor with a risk aversion of A = 3 should invest entirely in a risky portfolio with a standard deviation of 24% only if the risky portfolio's expected return is at least ______.

8.67%

9.84%

21.28%

D. 14.68%

C

42. In the mean standard deviation graph, the line that connects the risk-free rate and the optimal risky portfolio, P, is called the _________.

capital allocation line

indifference curve

investor's utility line

security market line

A

43. Most studies indicate that investors' risk aversion is in the range _____.

1-3

1.5-4

3-5.2

4-6

B

44. Two assets have the following expected returns and standard deviations when the risk-free rate is 5%: Asset A E(rA) = 10% σA = 20%

Asset B E(rB) = 15% σB = 27%

An investor with a risk aversion of A = 3 would find that _________________ on a risk-return basis.

only asset A is acceptable

only asset B is acceptable

neither asset A nor asset B is acceptable

D. both asset A and

asset B are acceptable

C

Historically, the best asset for the long-term investor wanting to fend off the threats of inflation and taxes while making his money grow has been

____.

A. stocks

B. bonds

C. money market funds

D. Treasury bills

A

46. The formula is used to calculate the _____________.

Sharpe ratio

Treynor measure

C. coefficient of variation

D. real rate

of return

A

A portfolio with a 25% standard deviation generated a return of 15% last year when T-bills were paying 4.5%. This portfolio had a Sharpe ratio of

____.

A. .22

B. .60

C. 42

D. .25

C

48. Consider a Treasury bill with a rate of return of 5% and the following risky securities: Security A: E(r) = .15; variance = .0400

Security B: E(r) = .10; variance = .0225 Security C: E(r) = .12; variance = .1000 Security D: E(r) = .13; variance = .0625

The investor must develop a complete portfolio by combining the risk-free asset with one of the securities mentioned above. The security the investor should choose as part of her complete portfolio to achieve the best CAL would be _________.

security A

security B

security C

D. security D

A

You purchased a share of stock for $29. One year later you received $2.25 as dividend and sold the share for $28. Your holding-period return was _________.

-3.57%

-3.45%

4.31%

D. 8.03%

C

50. Security A has a higher standard deviation of returns than security B. We would expect that:

I. Security A would have a higher risk premium than security B.

II. The likely range of returns for security A in any given year would be higher than the likely range of returns for security B.

The Sharpe ratio of A will be higher than the Sharpe ratio of B.

I only

I and II only

II and III only

I, II, and III

B

The holding-period return on a stock was 25%. Its ending price was $18, and its beginning price was $16. Its cash dividend must have been

_________.

$.25

$1

$2

D. $4

C

52. An investor invests 70% of her wealth in a risky asset with an expected rate of return of 15% and a variance of 5%, and she puts 30% in a Treasury bill that pays 5%. Her portfolio's expected rate of return and standard deviation are __________ and __________ respectively.

10%; 6.7%

12%; 22.4%

12%; 15.7%

D. 10%; 35%

C

The holding-period return on a stock was 32%. Its beginning price was $25, and its cash dividend was $1.50. Its ending price must have been

_________.

$28.50

$33.20

$31.50

D. $29.75

C

Consider the following two investment alternatives: First, a risky portfolio that pays a 15% rate of return with a probability of 40% or a 5% rate of return with a probability of 60%. Second, a Treasury bill that pays 6%. The risk premium on the risky investment is _________.

1%

3%

6%

D. 9%

B

Consider the following two investment alternatives: First, a risky portfolio that pays a 20% rate of return with a probability of 60% or a 5% rate of return with a probability of 40%. Second, a Treasury bill that pays 6%. If you invest $50,000 in the risky portfolio, your expected profit would be

_________.

$3,000

$7,000

$7,500

D. $10,000

B

You invest $10,000 in a complete portfolio. The complete portfolio is composed of a risky asset with an expected rate of return of 15% and a standard deviation of 21% and a Treasury bill with a rate of return of 5%. How much money should be invested in the risky asset to form a portfolio with an expected return of 11%?

$6,000

$4,000

$7,000

D. $3,000

A

You invest $1,000 in a complete portfolio. The complete portfolio is composed of a risky asset with an expected rate of return of 16% and a standard deviation of 20% and a Treasury bill with a rate of return of 6%. __________ of your complete portfolio should be invested in the risky portfolio if you want your complete portfolio to have a standard deviation of 9%.

100%

90%

45%

D. 10%

C

You invest $1,000 in a complete portfolio. The complete portfolio is composed of a risky asset with an expected rate of return of 16% and a standard deviation of 20% and a Treasury bill with a rate of return of 6%. A portfolio that has an expected value in 1 year of $1,100 could be formed if you _________.

place 40% of your money in the risky portfolio and the rest in the risk-free asset

place 55% of your money in the risky portfolio and the rest in the risk-free asset

place 60% of your money in the risky portfolio and the rest in the

risk-free asset

D. place 75% of your money in the risky portfolio

and the rest in the risk-free asset

A

You invest $1,000 in a complete portfolio. The complete portfolio is composed of a risky asset with an expected rate of return of 16% and a standard deviation of 20% and a Treasury bill with a rate of return of 6%. The slope of the capital allocation line formed with the risky asset and the risk-free asset is approximately _________.

A. 1.040

B. .80

C. .50

D. .25

C

You have $500,000 available to invest. The risk-free rate, as well as your borrowing rate, is 8%. The return on the risky portfolio is 16%. If you wish to earn a 22% return, you should _________.

invest $125,000 in the risk-free asset

invest $375,000 in the risk-free asset

borrow $125,000

D. borrow $375,000

D

The return on the risky portfolio is 15%. The risk-free rate, as well as the investor's borrowing rate, is 10%. The standard deviation of return on the risky portfolio is 20%. If the standard deviation on the complete portfolio is 25%, the expected return on the complete portfolio is _________.

6%

8.75 %

10%

D. 16.25%

D

You are considering investing $1,000 in a complete portfolio. The complete portfolio is composed of Treasury bills that pay 5% and a risky portfolio, P, constructed with two risky securities, X and Y. The optimal weights of X and Y in P are 60% and 40%, respectively. X has an expected rate of return of 14%, and Y has an expected rate of return of 10%. To form a complete portfolio with an expected rate of return of 11%, you should invest __________ of your complete portfolio in Treasury bills.

19%

25%

36%

D. 50%

A

You are considering investing $1,000 in a complete portfolio. The complete portfolio is composed of Treasury bills that pay 5% and a risky portfolio, P, constructed with two risky securities, X and Y. The optimal weights of X and Y in P are 60% and 40% respectively. X has an expected rate of return of 14%, and Y has an expected rate of return of 10%. To form a complete portfolio with an expected rate of return of 8%, you should invest approximately __________ in the risky portfolio. This will mean you will also invest approximately __________ and

__________ of your complete portfolio in security X and Y, respectively.

0%; 60%; 40%

25%; 45%; 30%

40%; 24%; 16%

D. 50%; 30%; 20%

C

You are considering investing $1,000 in a complete portfolio. The complete portfolio is composed of Treasury bills that pay 5% and a risky portfolio, P, constructed with two risky securities, X and Y. The optimal weights of X and Y in P are 60% and 40%, respectively. X has an expected rate of return of 14%, and Y has an expected rate of return of 10%. If you decide to hold 25% of your complete portfolio in the risky portfolio and 75% in the Treasury bills, then the dollar values of your positions in X and Y, respectively, would be __________ and _________.

$300; $450

$150; $100

$100; $150

D. $450; $300

B

You are considering investing $1,000 in a complete portfolio. The complete portfolio is composed of Treasury bills that pay 5% and a risky portfolio, P, constructed with two risky securities, X and Y. The optimal weights of X and Y in P are 60% and 40%, respectively. X has an expected rate of return of 14%, and Y has an expected rate of return of 10%. The dollar values of your positions in X, Y, and Treasury bills would be _________, __________, and __________, respectively, if you decide to hold a complete portfolio that has an expected return of 8%.

$162; $595; $243

$243; $162; $595

$595; $162; $243

D. $595; $243; $162

B

66. You have the following rates of return for a risky portfolio for several recent years: 2011 35.23% 2012 18.67% 2013 −9.87% 2014 23.45%

If you invested $1,000 at the beginning of 2011, your investment at the end of 2014 would be worth ___________.

$2,176.60

$1,785.56

$1,645.53

D. $1,247.87

B

67. You have the following rates of return for a risky portfolio for several recent years: 2011 35.23% 2012 18.67% 2013 −9.87% 2014 23.45%

The annualized (geometric) average return on this investment is _____.

16.15%

16.87%

21.32%

D. 15.60%

D

A security with normally distributed returns has an annual expected return of 18% and standard deviation of 23%. The probability of getting a return between -28% and 64% in any one year is _____.

68.26%

95.44%

99.74%

D. 100%

B

The Manhawkin Fund has an expected return of 16% and a standard deviation of 20%. The risk-free rate is 4%. What is the reward-to-volatility ratio for the Manhawkin Fund?

A. .8

B. .6

C. 9

D. 1

B

70. From 1926 to 2013 the world stock portfolio offered _____ return and _____ volatility than the portfolio of large U.S. stocks.

lower; higher

lower; lower

higher; lower

higher; higher

B

The price of a stock is $55 at the beginning of the year and $50 at the end of the year. If the stock paid a $3 dividend and inflation was 3%, what is the real holding-period return for the year?

-3.64%

-6.36%

-6.44%

D. -11.74%

C

72. The price of a stock is $38 at the beginning of the year and $41 at the end of the year. If the stock paid a $2.50 dividend, what is the holding-period return for the year?

6.58%

8.86%

14.47%

D. 18.66%

C

73. You invest all of your money in 1-year T-bills. Which of the following statements is (are) correct?

I. Your nominal return on the T-bills is riskless.

II. Your real return on the T-bills is riskless.

Your nominal Sharpe ratio is zero.

I only

I and III only

II only

I, II, and III

B

74. Which one of the following would be considered a risk-free asset in real terms as opposed to nominal?

A. money market fund

B. U.S. T-bill

C. short-term

corporate bonds

D. U.S. T-bill whose return was indexed to inflation

D

75. What is the geometric average return of the following quarterly returns: 3%, 5%, 4%, and 7%?

3.72%

4.23%

4.74%

D. 4.90%

C

76. What is the geometric average return over 1 year if the quarterly returns are 8%, 9%, 5%, and 12%?

8%

8.33 %

8.47%

D. 8.5 %

C

77. If the nominal rate of return on investment is 6% and inflation is 2% over a holding period, what is the real rate of return on this investment?

3.92%

4%

4.12%

D. 6%

A

According to historical data, over the long run which of the following assets has the best chance to provide the best after-inflation, after-tax rate of return?

A. long-term Treasury bonds

B. corporate bonds

C. common

stocks

D. preferred stocks

C

79. The buyer of a new home is quoted a mortgage rate of .5% per month. What is the APR on the loan?

A. .50%

5%

6%

D. 6.5%

C

80. (p. $$pageTag$$) A loan for a new car costs the borrower .8% per month. What is the EAR?

A. .80%

B. 6.87%

C. 9.6%

D. 10.03%

D

81. The CAL provided by combinations of 1-month T-bills and a broad index of common stocks is called the ______.

SML

CAPM

CML

total return line

C

82. Which of the following arguments supporting passive investment strategies is (are) correct?

I. Active trading strategies may not guarantee higher returns but guarantee higher costs.

II. Passive investors can free-ride on the activity of knowledge investors whose trades force prices to reflect currently available information.

Passive investors are guaranteed to earn higher rates of return than active investors over sufficiently long time horizons.

I only

I and II only

II and III only

I, II, and III

B

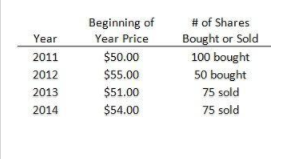

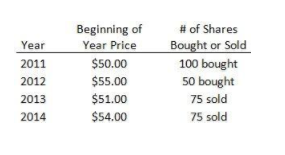

83. You have the following rates of return for a risky portfolio for several recent years. Assume that the stock pays no dividends.

what is the geometric average return for the period?

A. 2.87%

B. .74%

C. 2.6%

D. 2.21%

C

84. You have the following rates of return for a risky portfolio for several recent years. Assume that the stock pays no dividends.

What is the dollar-weighted return over the entire time period?

A. 2.87%

B..74%

C. 2.6%

D. 2.21%

B

If you believe you have a 60% chance of doubling your money, a 30% chance of gaining 15%, and a 10% chance of losing your entire investment, what is your expected return?

5%

15%

54.5%

D. 114.5%

C

86. The normal distribution is completely described by its _______.

mean and standard deviation

mean and variance

mode and standard deviation

D. median and variance

A

87. Which measure of downside risk predicts the worst loss that will be suffered with a given probablility?

standard deviation

variance

value at risk

D. Sharpe ratio

C

What is the VaR of a $10 million portfolio with normally distributed returns at the 5% VaR? Assume the expected return is 13% and the standard deviation is 20%.

A. 13%

B. -13%

C. 19.90%

D. -19.90

D

89. Your great aunt Zella invested $100 in 1925 in a portfolio of large U.S. stocks that earned a compound return of 10% annually.If she left that money to you, how much would be in the account 90 years later in 2015?

A. $1,000

B. $9,900

C. $531,302

D. $5,843,325

C